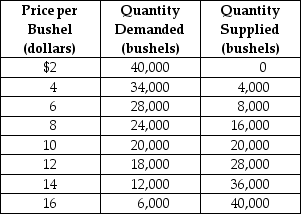

Table 4-9

Table 4-9 above contains information about the corn market. Answer the following questions based on this table.

Table 4-9 above contains information about the corn market. Answer the following questions based on this table.

-Refer to Table 4-9. An agricultural price floor is a price that the government guarantees farmers will receive for a particular crop. Suppose the federal government sets a price floor for corn at $12 per bushel.

a. What is the amount of shortage or surplus in the corn market as result of the price floor?

b. If the government agrees to purchase any surplus output at $12, how much will it cost the government?

c. If the government buys all of the farmers' output at the floor price, how many bushels of corn will it have to purchase and how much will it cost the government?

d. Suppose the government buys up all of the farmers' output at the floor price and then sells the output to consumers at whatever price it can get. Under this scheme, what is the price at which the government will be able to sell off all of the output it had purchased from farmers? What is the revenue received from the government's sale?

e. In this problem we have considered two government schemes: (1) a price floor is established and the government purchases any excess output and (2) the government buys all the farmers' output at the floor price and resells at whatever price it can get. Which scheme will taxpayers prefer?

f. Consider again the two schemes. Which scheme will the farmers prefer?

g. Consider again the two schemes. Which scheme will corn buyers prefer?

Definitions:

Tax Rate Schedules

Detailed charts provided by the IRS that determine the amount of tax an individual or entity owes based on their income level.

Progressive Tax Structure

A taxation system where tax rates increase as the taxable amount increases, resulting in higher income earners paying a larger percentage of their income in taxes.

Marginal Tax Rates

The rate at which an additional dollar of income would be taxed, which varies based on income levels and is a fundamental component of progressive tax systems.

Average Tax Rates

The ratio of the total amount of taxes paid to the total tax base (taxable income or spending), indicating the percentage of income that goes to taxes.

Q4: Deadweight loss refers to<br>A) the opportunity cost

Q5: In the United States in 2016,the percentage

Q11: The cities of Francistown and Nalady are

Q88: If the demand for letters written by

Q118: If a buyer in an economic transaction

Q149: _ occurs when one party takes advantage

Q235: The graph below represents the market for

Q269: Between 1981 and 2015,deaths from kidney disease

Q296: Health insurance plans which typically reimburse doctors

Q332: Assume that smartphones are a normal good,and