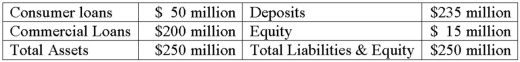

The average duration of the loans is 10 years. The average duration of the deposits is 3 years.  What is the number of T-bond futures contracts necessary to hedge the balance sheet if the duration of the deliverable bonds is 9 years and the current price of the futures contract is $96 per $100 face value?

What is the number of T-bond futures contracts necessary to hedge the balance sheet if the duration of the deliverable bonds is 9 years and the current price of the futures contract is $96 per $100 face value?

Definitions:

Second Founding

Refers to the period immediately following the Civil War, focusing on the Reconstruction amendments (13th, 14th, and 15th) that aimed to rebuild and redefine the United States.

Constitution

The fundamental set of laws and principles that outlines the government structure, rights of citizens, and powers of the state within a country.

Reconstruction

The period from 1865-1877 following the American Civil War, during which the Southern states were reorganized and reintegrated into the Union.

Waving the Bloody Shirt

A phrase that originated in the post-Civil War era representing the use of war memories or martyrs to galvanize public opinion or garner support, typically for political purposes.

Q30: In most countries, assets used to satisfy

Q37: The average duration of the loans is

Q40: Which of the following has proven to

Q72: A loan credit rating is the same

Q106: Identify the fundamental regulatory philosophy underlying the

Q132: Banks<br>A)Net buyer (typically)<br>B)Net seller (typically)

Q161: Tailing-the-hedge normally requires an FI manager to

Q169: An FI with a negative duration gap

Q188: The current price of June $100,000 T-Bonds

Q221: How is a hedge ratio commonly determined?<br>A)By