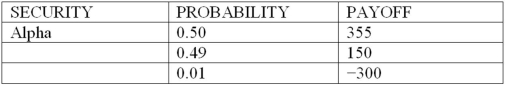

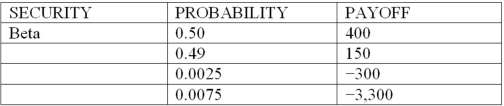

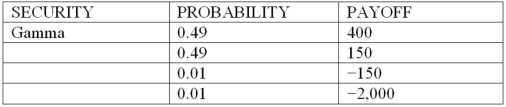

Consider the following discrete probability distributions of payoffs for 3 securities that are held in a DI's trading portfolio (payoff amounts shown are in $millions) :

What is the expected shortfall (ES) of securities Alpha and Beta at the 99 percent confidence level, respectively (in millions) ?

What is the expected shortfall (ES) of securities Alpha and Beta at the 99 percent confidence level, respectively (in millions) ?

Definitions:

Affirmative Action

Policies or measures that aim to increase opportunities for historically disadvantaged groups by considering those group memberships in decisions.

Reverse Discrimination

Discrimination against members of a dominant or majority group, often as a result of policies intended to correct discrimination against minority or disadvantaged groups.

EEO

Equal Employment Opportunity, a principle that ensures fair treatment to all employees and job applicants irrespective of race, color, religion, sex, national origin, age, disability, or genetic information.

Americans with Disabilities Act

A civil rights law that prohibits discrimination against individuals with disabilities in all areas of public life, including jobs, schools, transportation, and all public and private places open to the general public.

Q4: Subordinate debt (SD) has been proposed as

Q14: A corporation is planning to issue $10

Q17: A new computer system is expected to

Q25: Regina Bank has a policy of limiting

Q30: The expected return of a portfolio of

Q44: Using encryption technology to assist in the

Q46: Confidence Bank has made a loan to

Q49: Which of the following is NOT characteristic

Q62: The VaR of a bank's trading portfolio

Q66: An FI can immunize its portfolio by