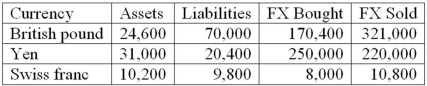

The following are the net currency positions of a Canadian FI (stated in Canadian dollars) .  How would you characterize the FI's risk exposure to fluctuations in the British pound to dollar exchange rate?

How would you characterize the FI's risk exposure to fluctuations in the British pound to dollar exchange rate?

Definitions:

Temporary Employees

Workers hired on a non-permanent basis to fill short-term needs of the employing organization.

Forecasting Labor Shortage

The process of predicting future shortages in the workforce based on current trends, demographic changes, and economic factors.

Forecasting Labor Surplus

The process of predicting periods during which the number of employees exceeds the number needed by the organization.

Forecasting

The process of making predictions based on past and present data and analyzing trends to anticipate future outcomes.

Q5: Consider the following discrete probability distributions of

Q19: In the Risk Metrics model, value at

Q37: Monte-Carlo simulation is a process of creating

Q50: Which of the following statements involving the

Q62: Encoding, endorsing, microfilming, and handling customers' checks.

Q66: The gap ratio is useful because it

Q74: Your U.S. bank issues a one-year U.S.

Q74: When using the Risk Metrics model, price

Q78: In general, the interest rate spread (spread

Q89: The following is an example of a