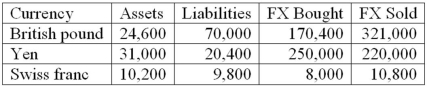

The following are the net currency positions of a Canadian FI (stated in Canadian dollars) .  How would you characterize the FI's risk exposure to fluctuations in the yen/dollar exchange rate?

How would you characterize the FI's risk exposure to fluctuations in the yen/dollar exchange rate?

Definitions:

Aggregate Production

The total output of goods and services produced by an economy over a specific time period.

Net National Product

The total market value of all final goods and services produced by the residents of a country in a given time period, minus depreciation.

Real GDP

Gross Domestic Product adjusted for inflation, measuring the value of goods and services produced by a country in real terms.

Base Year

A specific year against which economic growth is measured, serving as a standard comparison for financial indices and economic data.

Q5: One of the problems with estimating expected

Q5: Which of the following wholesale services offered

Q9: The interest rate paid deposit accounts by

Q24: Banks with relatively high loan commitments face

Q48: For given changes in interest rates, the

Q61: The FI is acting as a hedger

Q67: The following is an example of a

Q75: Increases in the rate of innovation of

Q88: Wholesale cash management services allow corporate customers

Q100: From the perspective of an FI, which