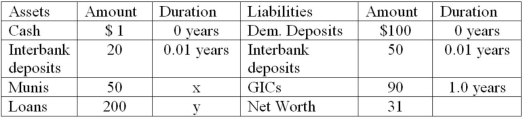

The following is an FI's balance sheet ($millions) .  Notes to Balance Sheet: Munis are 2-year 6 percent annual coupon municipal notes selling at par. Loans are floating rates, repriced quarterly. Spot discount yields for 91-day Treasury bills are 3.75 percent. GICs are 1-year pure discount certificates of deposit paying 4.75 percent.

Notes to Balance Sheet: Munis are 2-year 6 percent annual coupon municipal notes selling at par. Loans are floating rates, repriced quarterly. Spot discount yields for 91-day Treasury bills are 3.75 percent. GICs are 1-year pure discount certificates of deposit paying 4.75 percent.

What will be the impact, if any, on the market value of the bank's equity if all interest rates increase by 75 basis points?

Definitions:

Substitute Resource

A resource or product that can be used in place of another to fulfill a similar function or need.

Marginal Revenue Product Curve

A graphical representation showing how the revenue generated from selling an additional unit of a good or service changes as more units are produced.

Purely Competitive Seller

A firm operating in a market where it must accept the prevailing market price and cannot influence it.

Law of Diminishing Returns

An economic principle stating that as investment in a particular area increases, the rate of profit from that investment, after a certain point, cannot continue to increase if other inputs remain at a constant.

Q9: The exposure to foreign exchange risk by

Q38: The amount of security or collateral on

Q41: In the event of financial distress, open-ended

Q47: In order to realize a return on

Q60: For life insurance companies, the distribution of

Q64: The function of institutional venture capital firms

Q67: The following is an example of a

Q80: Principal transactions allow the market maker to

Q99: Hadbucks National Bank current balance sheet appears

Q107: Foreign exchange rate risk occurs because foreign