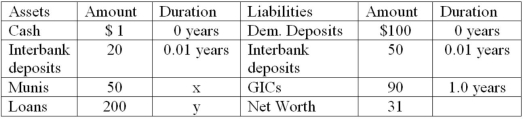

The following is an FI's balance sheet ($millions) .  Notes to Balance Sheet: Munis are 2-year 6 percent annual coupon municipal notes selling at par. Loans are floating rates, repriced quarterly. Spot discount yields for 91-day Treasury bills are 3.75 percent. GICs are 1-year pure discount certificates of deposit paying 4.75 percent.

Notes to Balance Sheet: Munis are 2-year 6 percent annual coupon municipal notes selling at par. Loans are floating rates, repriced quarterly. Spot discount yields for 91-day Treasury bills are 3.75 percent. GICs are 1-year pure discount certificates of deposit paying 4.75 percent.

What is this bank's interest rate risk exposure, if any?

Definitions:

Form Letter

A template document that contains fixed text and variables, which can be automatically filled in with personalized information for multiple recipients.

Chart Wizard

A guided tool in spreadsheet software that simplifies the process of creating and customizing charts from data sets.

Number Field

A type of data field in databases and forms designed to hold numerical values, often used for calculations or statistical analysis.

Chart Type

A categorization of graphs or charts based on their style or manner of presenting data, such as bar, line, pie, or scatter charts.

Q2: Duration of a fixed-rate coupon bond will

Q10: Investment banks engage in activities such as

Q10: The following represents two yield curves. <img

Q29: On loans fully secured by physical, non-real

Q30: The following are the net currency positions

Q32: A bank's net deposit drain<br>A)is negative if

Q49: Assuris is administered by CDIC.

Q54: Lenders may find it beneficial to reschedule

Q91: Which term refers to the risk that

Q96: Which of the following may occur when