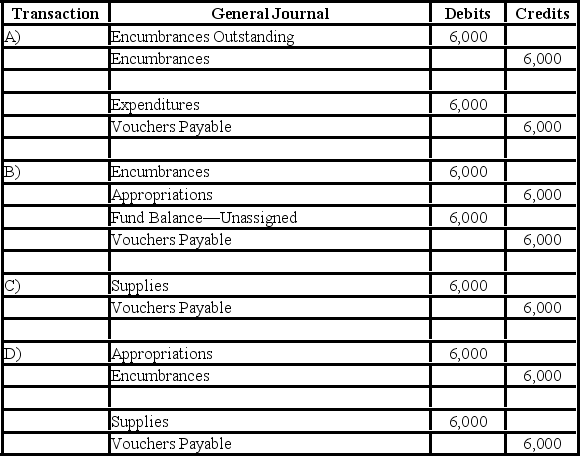

The City of Island Grove uses encumbrance accounting and its fiscal year ends on June 30. On May 6, a purchase order was approved and issued for supplies in the amount of $6,000. Island Grove received these supplies on June 2, and the $6,000 invoice was approved for payment. What General Fund journal entry or entries should Island Grove make on June 2, upon receipt of the supplies and approval of the invoice?

Definitions:

Total Dividends

The sum of all dividend payments made to shareholders for a particular period, typically a fiscal year.

Retained Earnings

Earnings accumulated by a company thus far, minus any shareholder dividends or distributions already issued.

Share Price

The current price at which a single share of a company can be bought or sold in the market.

Market Risk

The possibility of an investor experiencing losses due to factors that affect the overall performance of the financial markets.

Q1: The City of Island Grove uses encumbrance

Q19: The City of Oak Park constructed a

Q20: Performance audits are independent assessments of performance

Q24: The account Deferred Inflows of Resources-Unavailable Revenues

Q27: The legal level of budgetary control represents

Q31: An employee pension fund is a common

Q36: A discretely presented component unit is presented

Q47: According to the GASB, which of the

Q50: Which of the following statements regarding the

Q53: Under GASB standards, the financial statements that