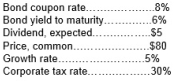

Given an optimal capital structure that is 50% debt and 50% common stock, calculate the weighted average cost of capital for the company given the following additional information:

Definitions:

Territorial Division

The division or partitioning of land or space into separate areas, often for administrative or legal purposes.

Oligopolistic Market

A market structure characterized by a small number of firms that dominate the market, often leading to limited competition.

Regional Monopoly

A regional monopoly exists when a single firm dominates the market for a particular good or service in a geographic area.

Herfindahl-Hirschman Index

A measure of market concentration that squares and then sums the market shares of all firms within an industry, indicating the level of competition.

Q1: Financial capital does not include<br>A) stocks.<br>B) bonds.<br>C)

Q23: Discounting refers to devaluing the item from

Q33: A key influence in recent years has

Q60: Using the constant growth model, a firm's

Q62: For acceptable investments, the reinvestment assumption under

Q74: The time value of money is not

Q75: A firm that does not earn the

Q91: Given an optimal capital structure that is

Q100: Under the "modified accelerated-cost-recovery system" (MACRS) of

Q104: Well-implemented Web-based supply chain management has all