-A regulated firm may have an incentive to spend an inefficiently high amount on capital when:

Definitions:

Arbitrage Profit

Earnings generated by exploiting the price differences of identical or similar financial instruments on different markets or in different forms.

Oil Futures

Oil futures are contracts to buy or sell oil at a predetermined price on a specified future date, used for hedging or speculation on oil price movements.

Risk-Free Rate

The rate of return on an investment with no risk of financial loss, typically associated with government bonds.

Oil Futures

Contracts to buy or sell oil at a predetermined price on a specified future date, used as a financial instrument for hedging or speculative purposes.

Q25: When women and members of other minority

Q47: Why do market failures arise in case

Q48: A market in which adverse selection occurs

Q59: If the coupon-rate of a particular bond

Q63: Moral hazard is the term used to

Q68: Consider the monopolistically competitive firm described in

Q69: Consider the perfectly competitive firm described

Q71: A monopolistically competitive firm maximizes profit at

Q77: By forming a cartel the member firms

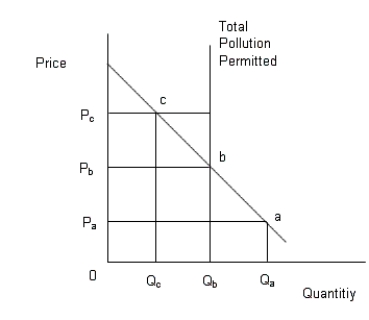

Q83: The figure given below represents equilibrium in