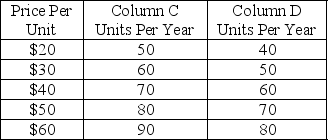

Refer to the table below. Relative to column C, column D represents:

Definitions:

FICA Tax

Federal Insurance Contributions Act tax, a payroll tax deducted from employees' wages for Social Security and Medicare benefits.

Employer

An individual or business entity that hires and pays wages or salaries to one or more employees in exchange for their work.

Paychecks

Documents issued by an employer to an employee to pay for services rendered, representing salary or wages.

Withheld FICA Tax

Taxes taken out of an employee's paycheck for Social Security and Medicare.

Q21: First degree murder is a homicide that

Q22: If the price of a good in

Q33: Martha saw a woman slip and fall

Q33: The table below shows how total donations,

Q40: A felony is often punishable by:<br>A) a

Q45: What type of homicide involves an impulsive

Q50: Refer to the figure below. Suppose the

Q76: Macroeconomic issues include all of the following

Q95: Refer to the table below. The marginal

Q164: The United States generally has a comparative