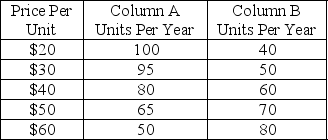

Refer to the table below. Suppose the columns in this table reflect demand and supply. At a price of $50:

Definitions:

Married Taxpayers

Couples legally married who can choose to file joint or separate tax returns, which can affect their tax liabilities and benefits.

Tax Liability

The total amount of tax owed to a taxing authority based on the taxable income of an individual or corporation.

Taxable Income

The amount of income used to calculate an individual's or a company's income tax due, determined by subtracting deductions and exemptions from total income.

Tax Liability

The total amount of taxes owed by an individual, corporation, or other entity to taxing authorities, such as the federal or state government, based on income, property value, or other taxable assets.

Q2: Economists believe the Cost-Benefit Principle is:<br>A) a

Q9: The form of arbitration in which the

Q14: Lou and Alex live together and share

Q63: Refer to the figure below. Moving from

Q75: Suppose it takes Dan 5 minutes to

Q115: If business inventories equal $40 billion at

Q121: A particularly strong expansion is called a(n):<br>A)

Q126: What might cause a decrease in supply

Q129: Output per worker must be _ output

Q141: A trade imbalance occurs when:<br>A) exports from