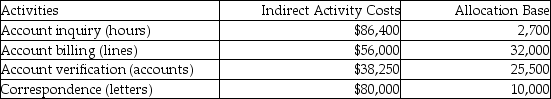

Potter & Weasley Company had the following activities, estimated indirect activity costs, and allocation bases:  Potter & Weasley uses activity based costing.

Potter & Weasley uses activity based costing.

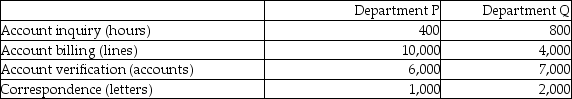

The above activities are used by Departments P and Q as follows: What is the cost per driver unit for the account inquiry activity?

What is the cost per driver unit for the account inquiry activity?

Definitions:

Tall Versus Flat

A description comparing organizational structures where "tall" refers to many hierarchical levels and "flat" signifies fewer levels and potentially more decentralized decision-making.

Management Hierarchy

The arrangement of authoritative levels within an organization, often depicted as a pyramid, where each level has different levels of responsibility and authority.

Divide Labour

The allocation of different parts of a manufacturing process or task to different individuals in order to improve efficiency and productivity.

Index

A statistical measure or indicator that tracks changes in various sectors, such as a stock market index, which measures the performance of a particular section of the stock market.

Q24: When units are transferred from Processing Department

Q48: ABC tends to increase the unit cost

Q52: Job costing systems accumulate the costs for

Q55: The following information is provided by Arrow

Q107: When units are transferred from Processing Department

Q150: Which item would appear last on a

Q173: The following information was gathered for the

Q184: Fun Stuff Manufacturing produces frisbees using a

Q210: Product testing is an appraisal cost.

Q269: Kramer Manufacturing produces blenders. Its total fixed