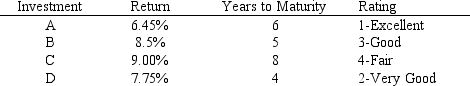

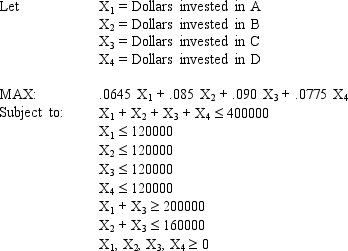

A financial planner wants to design a portfolio of investments for a client. The client has $400,000 to invest and the planner has identified four investment options for the money. The following requirements have been placed on the planner. No more than 30% of the money in any one investment, at least one half should be invested in long-term bonds which mature in six or more years, and no more than 40% of the total money should be invested in B or C since they are riskier investments. The planner has developed the following LP model based on the data in this table and the requirements of the client. The objective is to maximize the total return of the portfolio.

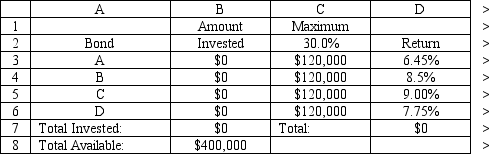

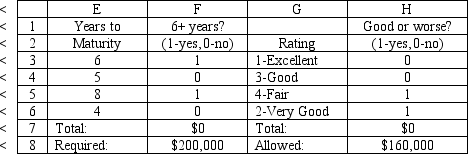

What values would you enter in the Risk Solver Platform (RSP) task pane for the following cells for this Excel spreadsheet implementation of this problem?

What values would you enter in the Risk Solver Platform (RSP) task pane for the following cells for this Excel spreadsheet implementation of this problem?

Objective Cell:

Variables Cells:

Constraints Cells:

Definitions:

Total Assets

The sum of all assets owned by an entity, including both current and long-term assets, representing the total value of what the entity owns.

Profitability

The ability of a firm to earn income.

Days' Sales

A financial metric that compares a company's average receivables to its average daily sales, indicating how fast the company collects payments from customers.

Inventory

The total quantity of goods and materials a business holds for the purpose of resale or production.

Q3: In which of the following categories of

Q3: What is the objective function in the

Q6: Which step of the problem-solving process is

Q11: Suppose that the first goal in

Q24: Is the optimal solution to this problem

Q29: An office supply company is attempting to

Q56: Suppose that X<sub>1</sub> equals 4. What are

Q62: What is the soft constraint form

Q109: Moral hazard occurs because people act<br>A) in

Q308: A Lorenz curve graphs the difference between