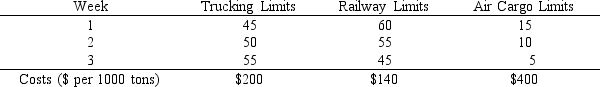

Carlton construction is supplying building materials for a new mall construction project in Kansas. Their contract calls for a total of 250,000 tons of material to be delivered over a three-week period. Carlton's supply depot has access to three modes of transportation: a trucking fleet, railway delivery, and air cargo transport. Their contract calls for 120,000 tons delivered by the end of week one, 80% of the total delivered by the end of week two, and the entire amount delivered by the end of week three. Contracts in place with the transportation companies call for at least 45% of the total delivered be delivered by trucking, at least 40% of the total delivered be delivered by railway, and up to 15% of the total delivered be delivered by air cargo. Unfortunately, competing demands limit the availability of each mode of transportation each of the three weeks to the following levels (all in thousands of tons):

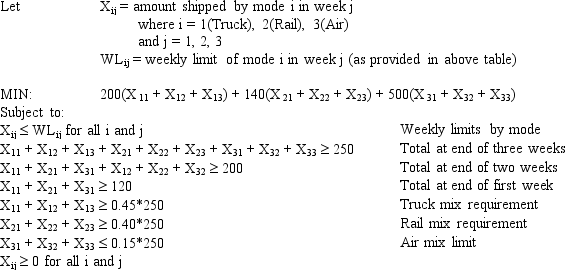

The following is the LP model for this logistics problem.

The following is the LP model for this logistics problem.

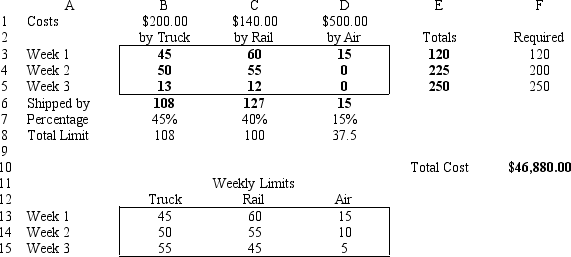

What values would you enter in the Risk Solver Platform (RSP) task pane for the cells in this Excel spreadsheet implementation of this problem?

What values would you enter in the Risk Solver Platform (RSP) task pane for the cells in this Excel spreadsheet implementation of this problem?

Objective Cell:

Variables Cells:

Constraints Cells:

Definitions:

Points

In finance, points refer to a unit of measurement used to describe the percentage change in financial instruments, or fees paid upfront on a loan expressed as a percentage of the loan amount.

Normative Views

Opinions or judgments based on what is considered right or desirable, often contrasted with empirical or factual statements.

Positive Theory

A theory that aims to explain how things are, focusing on factual and objective analysis rather than on what should be.

Tax Policy

Refers to the government's approach to taxation, including the determination of tax rates, exemptions, and regulations affecting the tax liability of individuals and businesses.

Q8: Which formula should be used to determine

Q10: A node which can both send to

Q20: Given the following goal constraints<br>5 X<sub>1</sub> +

Q25: A situation when decision quality is good

Q47: Refer to Exhibit 3.5. What formula should

Q86: The above figure shows the utility of

Q152: A progressive tax is a tax that

Q155: Andrew has the utility of wealth curve

Q209: The biggest single factor affecting household income

Q321: The 2010 U.S. Federal Personal Income six