Exhibit 3.4

The following questions are based on this problem and accompanying Excel windows.

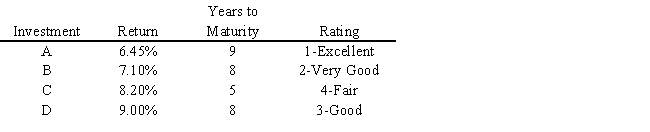

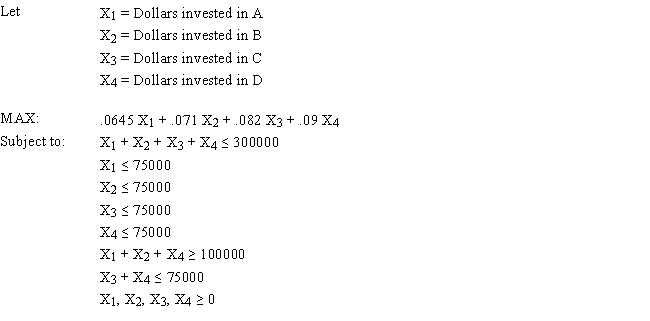

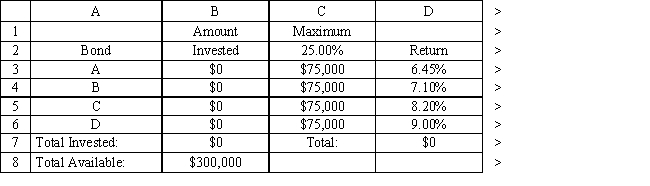

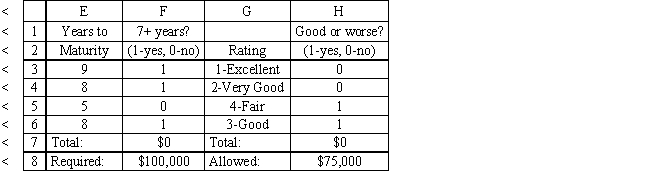

A financial planner wants to design a portfolio of investments for a client. The client has $300,000 to invest and the planner has identified four investment options for the money. The following requirements have been placed on the planner. No more than 25% of the money in any one investment, at least one third should be invested in long-term bonds which mature in seven or more years, and no more than 25% of the total money should be invested in C or D since they are riskier investments. The planner has developed the following LP model based on the data in this table and the requirements of the client. The objective is to maximize the total return of the portfolio.

-Refer to Exhibit 3.4. What formula should be entered in cell D7 in the accompanying Excel spreadsheet to compute the total return?

Definitions:

Converting Labor

The process of transforming labor into tangible outputs, typically in manufacturing or production environments.

Other Resources

Additional assets or support mechanisms that can be utilized to achieve specific goals or improve efficiency, including human skills, technology, and information.

Flexible Production

A manufacturing strategy that enables a company to adjust and reconfigure its production line quickly to adapt to changes in market demand or product design.

Automation

Automation involves using technology and machinery to perform tasks with minimal human assistance, aimed at increasing efficiency, reducing errors, and saving time and resources.

Q3: Refer to Exhibit 10.1. Suppose that for

Q17: R<sup>2</sup> is also referred to as<br>A)coefficient of

Q19: Refer to Exhibit 3.5. Which cells are

Q24: The straight line (Euclidean) distance between two

Q29: A company needs to hire workers to

Q32: The Big Bang explosives company produces customized

Q39: When using the GRG algorithm to solve

Q46: Which of the following statements is true

Q52: A common objective in the product mix

Q141: Consider a market for used cars. Suppose