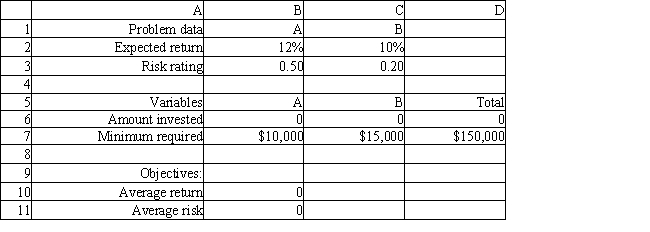

Exhibit 7.2

The following questions are based on the problem below.

An investor has $150,000 to invest in investments A and B. Investment A requires a $10,000 minimum investment, pays a return of 12% and has a risk factor of .50. Investment B requires a $15,000 minimum investment, pays a return of 10% and has a risk factor of .20. The investor wants to maximize the return while minimizing the risk of the portfolio. The following multi-objective linear programming (MOLP) has been solved in Excel.

-Refer to Exhibit 7.2. Which cells are the changing cells in this model?

Definitions:

Market Return

The total return on investment from a particular market or index, including dividends and capital gains.

Earnings Per Share

Earnings per share (EPS) is a financial metric that divides a company's profit by the number of its outstanding shares, indicating the company's profitability on a per-share basis.

Efficient Market

A market hypothesis that posits that asset prices fully reflect all available information, making it impossible to consistently achieve higher returns.

Investor Expectations

The assumptions or beliefs about future economic and financial market conditions that influence investment decisions.

Q10: The following linear programming problem has been

Q12: For a Poisson random variable,

Q22: If the "Standard LP/Quadratic Engine" option is

Q32: An investor wants to determine how

Q32: Which type of spreadsheet cell represents the

Q36: Refer to Exhibit 13.5. Based on this

Q40: For maximization problems, the optimal objective function

Q61: Refer to Exhibit 7.4. Based on the

Q76: Refer to Exhibit 11.21. What is the

Q143: Larry owns a car worth $20,000, and