-If a unit excise tax is placed on a good for which the demand is very unresponsive to a price change, then

Definitions:

Payee

The party in a financial transaction to whom money is paid or is to be paid.

Interest Income

Earnings received from deposit accounts or investments that yield interest, such as savings accounts, bonds, or loans.

Accounts Receivable

An asset account that records amounts a company has a right to receive because it has provided goods or services on credit.

Nontrade Receivables

Amounts owed to a company that are not related to the sale of goods or services, such as tax refunds or loans to employees.

Q14: In 2013, the price for a market

Q52: A current concern about Social Security is

Q72: What is the business cycle? How "cyclical"

Q87: The purchasing power of the dollar<br>A) increases

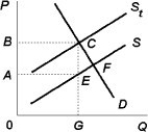

Q134: If the government pays a per-unit subsidy

Q159: The purpose of an effluent fee imposed

Q189: You receive a 5 percent raise in

Q302: Which of the following explains why frictional

Q346: According to the above table, in the

Q390: Which of the following price indexes is