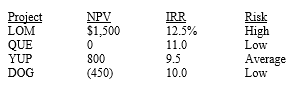

A college intern working at Anderson Paints evaluated potential investments⎯that is,capital budgeting projects⎯using the firm's average required rate of return (WACC) ,and he produced the following report for the capital budgeting manager:  The capital budgeting manager usually considers the risks associated with capital budgeting projects before making her final decision.If a project has a risk that is different from average,she adjusts the average required rate of return by adding or subtracting 2 percentage points.If the four projected listed above are independent,which one(s) should the capital budgeting manager recommend be purchased?

The capital budgeting manager usually considers the risks associated with capital budgeting projects before making her final decision.If a project has a risk that is different from average,she adjusts the average required rate of return by adding or subtracting 2 percentage points.If the four projected listed above are independent,which one(s) should the capital budgeting manager recommend be purchased?

Definitions:

Supermarket Chains

Large retail organizations made up of a number of branches or stores that sell groceries and other goods, often under a common brand.

Call-in Poll

A survey method where participants provide their responses or opinions over telephone calls, typically used in public opinion polling.

USA Today

A national American daily newspaper known for its comprehensive news coverage and distinctive layout.

Statistic

A numerical measurement describing some aspect of a sample of data, often used in inferential statistics.

Q2: Assume that you plan to buy a

Q2: Deciding upon the form of organization for

Q9: The term structure is defined as the

Q25: A company is analyzing two mutually exclusive

Q32: If the risk-free rate is 7 percent,the

Q48: Which of the following statements about bonds

Q51: Which of the following business decisions can

Q58: All else equal,a risk averse investor choosing

Q69: Suppose a firm wants to maintain a

Q86: As a corporate investor paying a marginal