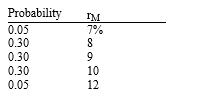

The probability distribution for rM for the coming year is as follows:  If rRF = 6.05% and Stock X has a beta of 2.0,an expected constant growth rate of 7 percent,and D0 = $2,what market price gives the investor a return consistent with the stock's risk?

If rRF = 6.05% and Stock X has a beta of 2.0,an expected constant growth rate of 7 percent,and D0 = $2,what market price gives the investor a return consistent with the stock's risk?

Definitions:

Earrings

Jewelry worn on the earlobes or other parts of the ear, often decorative and made from various materials like metal, stones, or beads.

Ounces

A unit of weight in the avoirdupois (approximately 28.35 grams) or troy (approximately 31.10 grams) systems.

Gold

A precious metal with high economic value, often used in jewelry, electronics, and as an investment.

Turquoise

A blue-to-green mineral that's often used as a gemstone in jewelry and decorative items.

Q10: An investor who is risk averse requires

Q17: Which of the following statements is correct?<br>A)

Q34: Lombardi Trucking Company has the following data:

Q54: The last dividend paid by Klein Company

Q89: Modular Systems Inc.just paid dividend D<sub>0</sub>,and it

Q113: You have the opportunity to buy a

Q114: If Miller and Modigliani had considered the

Q116: Which of the following is a key

Q133: The depreciable base of an asset includes

Q141: Regarding the net present value of a