Your Company Is Choosing Between the Following Non-Repeatable,equally Risky,mutually Exclusive

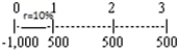

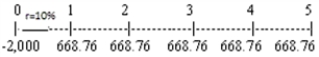

Your company is choosing between the following non-repeatable,equally risky,mutually exclusive projects with the cash flows shown below.Your required rate of return is 10 percent.How much value will your firm sacrifice if it selects the project with the higher IRR?

Project S:  Project L:

Project L:

Definitions:

Chi-Square Distribution

A statistical distribution that is used to describe the distribution of a sum of the squares of k independent standard normal random variables, useful in hypothesis testing and constructing confidence intervals.

Degrees Of Freedom

The number of independent values or quantities which can be assigned to a statistical distribution or to a system without violating any constraints.

Left-Tailed Area

Refers to the area under the probability distribution curve to the left of a specified value, often used in hypothesis testing to determine significance.

Multinomial Experiment

An experiment or trial that results in outcomes classified into more than two categories, where the probabilities of outcomes are fixed.

Q10: Because the computations for different market indexes

Q11: The simple arithmetic average return for the

Q20: To be broker or to trade securities

Q22: A firm constructing a new manufacturing plant

Q38: If you know that your firm is

Q48: Refer to Foxy Ladies Investment Club.What is

Q51: Discount brokers can offer trades at lower

Q55: It has been shown that a firm's

Q65: A _ order is an order to

Q129: Although the payback method ignores the time