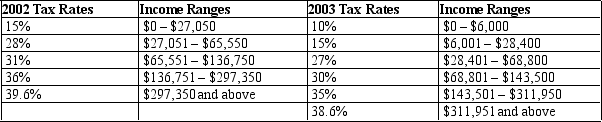

Table 12-12

United States Income Tax Rates for a Single Individual,2002 and 2003.

-Refer to Table 12-12.Charles is a single person whose taxable income is $35,000 a year.What happened to his average tax rate between 2002 and 2003?

Definitions:

Fair Value

The likely receipts from offloading an asset or the expenditure to relocate a liability, in a systematic transaction at the market rate on the day of valuation.

Initial Value Method

An accounting method where investments are recorded at their acquisition cost without subsequent change except for impairments and certain adjustments.

Full-Accrual Totals

A method of accounting that records revenues when earned and expenses when incurred, regardless of when cash transactions occur.

Consolidation Worksheet

A consolidation worksheet is a tool used in the preparation of consolidated financial statements. It helps in the adjustment and elimination of intra-group transactions and balances among the parent and subsidiary companies.

Q6: Refer to Figure 13-1.Which of the following

Q56: The government provides public goods because<br>A) private

Q141: Refer to Scenario 13-1.Suppose Joe purchases the

Q146: If the use of a common resource

Q202: Which of the following statements is correct?<br>A)

Q211: Bev is opening her own court-reporting business.She

Q256: You are the mayor of a town

Q335: In the short run,a firm incurs fixed

Q361: Refer to Table 12-9.For this tax schedule,what

Q361: A firm has a fixed cost of