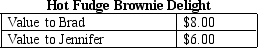

Table 12-4

-Refer to Table 12-4.Suppose that the government imposes a $2 tax on delights,causing the price to increase from $5.00 to $7.00.Total consumer surplus

Definitions:

Perpetual Basis

An approach or method without a predetermined end date, continuing indefinitely.

Current Ratio

A liquidity ratio that measures a company's ability to pay short-term obligations or those due within one year, calculated by dividing current assets by current liabilities.

LIFO Reserve

The difference between the cost of inventory calculated using the Last In, First Out method and the First In, First Out method.

Current Assets

Assets that are expected to be converted into cash, sold, or consumed within one year or within the business's operating cycle.

Q4: Refer to Table 12-11.For an individual with

Q17: Refer to Table 12-9.For this tax schedule,what

Q51: Larry's Lunchcart is a small street vendor

Q182: As Al's Radiator Company adds workers while

Q193: Which tax system requires higher-income taxpayers to

Q250: Refer to Table 13-1.Suppose that Alyson's pet

Q281: Which of the following is an example

Q307: A budget deficit<br>A) occurs when government receipts

Q341: Refer to Scenario 12-3.The taxpayer faces<br>A) a

Q375: If the government imposes a tax of