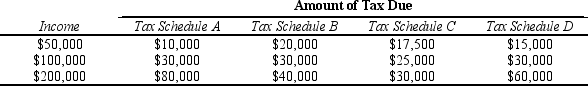

Table 12-11

The following table presents the total tax liability for an unmarried taxpayer under four different tax schedules for the income levels shown.

-Refer to Table 12-11.For an individual with $200,000 in taxable income,which tax schedule has the lowest marginal tax rate?

Definitions:

Encoding

The process of converting information into a form that allows it to be stored in our memory.

Attention

The cognitive process of selectively concentrating on one aspect of the environment while ignoring other things.

Early-Selection Model

A theory in cognitive psychology suggesting that information is filtered, or selected for further processing, early in the perceptual process.

Late-Selection Model

A theory in cognitive psychology suggesting that the selection of information for final processing occurs late in the processing sequence.

Q56: Refer to Figure 13-9.At levels of output

Q191: Economists normally assume that the goal of

Q207: Refer to Table 13-8.Eileen has received an

Q213: Refer to Table 12-4.Suppose that the government

Q221: Suppose that in 2015 the average citizen's

Q236: Adam Smith's example of the pin factory

Q264: The argument that each person should pay

Q296: The average total cost curve is unaffected

Q300: As government debt increases,<br>A) Congress will reduce

Q342: Refer to Table 13-7.What is the marginal