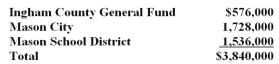

Ingham County collects,in addition to its own taxes,taxes for other units.Tax levied for 2014 were as follows:

Collections from the 2014 levies amounted to $3,550,000 and were distributed in proportion to the original levies,less a 1% collection fee charged Mason City and the Mason School District.Collection fees are remitted to the Ingham County General Fund.

Collections from the 2014 levies amounted to $3,550,000 and were distributed in proportion to the original levies,less a 1% collection fee charged Mason City and the Mason School District.Collection fees are remitted to the Ingham County General Fund.

Required

1)Record the tax levies in the Ingham County Tax Agency Fund.

2)Record the collection from the 2014 tax levies in the Ingham County Tax Agency Fund and the specific liabilities owed each fund and unit (Round all amounts to the nearest whole dollar.)

3)Record in the Ingham County Tax Agency Fund the transfer of collected taxes to each fund and unit.

Definitions:

Right to Vote

The entitlement of citizens to participate in their government's electoral process by choosing officials or making decisions in referendums.

Past Discrimination

Refers to historical injustices and unequal treatment based on race, gender, religion, or other characteristics, often requiring remedies or affirmative actions.

Affirmative Action

Policies that support measures to increase opportunities for underrepresented groups in areas such as employment, education, and business, often to correct historical injustices.

De Facto Segregation

Racial segregation that occurs in schools, workplaces, and residential areas, not as a result of laws, but as a result of patterns of inequality in society.

Q6: The statement of financial position prepared by

Q7: Public colleges and universities that use business-type

Q8: Which of the following is not true

Q15: Which of the following fund types is

Q19: Your client is a nongovernmental not-for-profit museum

Q22: Which of the following statements concerning the

Q25: Contingencies that are unique to health care

Q33: Describe what prepaid health care plans are

Q46: Independent health care organizations that associate for

Q51: Ingham County collects,in addition to its own