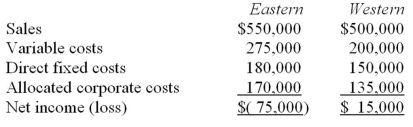

Cook Company has two divisions-Eastern and Western.The divisions have the following revenues and expenses:  The management of Cook is considering the elimination of the Eastern Division.If the Eastern Division were eliminated,the direct fixed costs associated with this division could be avoided.However,corporate costs would still be $305,000 in total.Given these data,the elimination of the Eastern Division would result in an overall company net income (loss) of:

The management of Cook is considering the elimination of the Eastern Division.If the Eastern Division were eliminated,the direct fixed costs associated with this division could be avoided.However,corporate costs would still be $305,000 in total.Given these data,the elimination of the Eastern Division would result in an overall company net income (loss) of:

Definitions:

Direct Materials Cost

The cost of raw materials that can be directly attributed to the production of a finished good.

Activity-Based Costing

A costing methodology that assigns overhead and indirect costs to specific products or activities based on their consumption of resources.

Direct Labor-Hours

The total hours worked by employees directly involved in the production of goods.

Direct Materials Cost

The cost of raw materials that are directly traceable to the production of a specific product.

Q35: Northern Stores is a retailer in the

Q53: In a certain standard costing system the

Q54: Wattis Manufacturing has established the following master

Q67: For the past year,the turnover was?<br>A) 2.<br>B)

Q78: What is the materials quantity variance for

Q91: The total amount of overhead cost allocated

Q116: The difference between total sales in dollars

Q124: Which department is usually held responsible for

Q138: Suppose that regular sales of jigs total

Q164: Condensed financial statements of Miller Company at