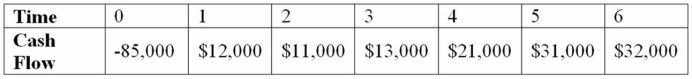

Suppose your firm is considering investing in a project with the cash flows shown below, that the required rate of return on projects of this risk class is 10 percent, and that the maximum allowable payback and discounted payback statistics for the project are 3.5 and 4.5 years, respectively. Use the IRR decision to evaluate this project; should it be accepted or rejected?

Definitions:

Q1: How many possible IRRs could you find

Q18: If a firm has a cash cycle

Q34: Goldilochs Inc. reported sales of $5 million

Q48: Suppose a firm has a dividend payout

Q53: Suppose your firm is considering investing in

Q58: ADK has 30,000 15-year 9% semi-annual coupon

Q58: Which statement is most correct regarding how

Q64: What would prompt a firm like GE

Q76: Which of the following statements is incorrect?<br>A)

Q76: Risk versus Return Rank the following three