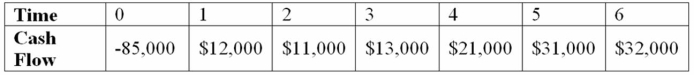

Suppose your firm is considering investing in a project with the cash flows shown below, that the required rate of return on projects of this risk class is 10 percent, and that the maximum allowable payback and discounted payback statistics for the project are 3.5 and 4.5 years, respectively. Use the NPV decision to evaluate this project; should it be accepted or rejected?

Definitions:

Excise Tax

A specific type of tax levied on particular goods, services, or transactions, often included in the price of items such as gasoline, alcohol, and tobacco.

Taxable Income

The portion of an individual's or a corporation's income that is subject to taxes according to governmental regulations.

Marginal Tax Rate

The tax rate that applies to the next dollar of taxable income, indicating the percentage of any additional income that will be paid in taxes.

Taxable Income

The portion of an individual's or corporation's income that is subject to taxes by the government, after all deductions and exemptions.

Q2: HiLo, Inc., doesn't face any taxes and

Q17: Compute the PI statistic for Project Z

Q36: A measure of the sensitivity of a

Q56: Use the MIRR decision rule to evaluate

Q60: GTB, Inc., has a 34 percent tax

Q88: HiLo, Inc., doesn't face any taxes and

Q98: Which of the following is a money-market

Q100: Use the payback decision rule to evaluate

Q101: Show mathematically that, with a tax rate

Q128: Happy Feet would like to maintain their