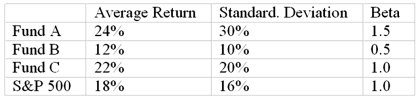

You want to evaluate three mutual funds using the Sharpe measure for performance evaluation.The risk-free return during the sample period is 6%.The average returns, standard deviations, and betas for the three funds are given below, as are the data for the S&P 500 Index.  The fund with the highest Sharpe measure is

The fund with the highest Sharpe measure is

Definitions:

Fear-victimization Paradox

The phenomenon where people's fear of becoming a crime victim is disproportionately high compared to actual victimization rates, influenced by factors such as media portrayal of crime.

Theory of Planned Behavior

A psychological theory that predicts an individual's intention to engage in a behavior based on three factors: attitude toward the behavior, subjective norms, and perceived behavioral control.

Model Components

The essential parts or elements that make up a theoretical framework or model.

Emotional Support

Assistance offered through empathy, concern, and love to help a person deal with emotional stress or challenges.

Q7: An example of a _ strategy is

Q9: You want to evaluate three mutual funds

Q18: Which of the following is an uncontrollable

Q19: The fundamental difference between quotas and import

Q27: Consider these two investment strategies: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB2464/.jpg"

Q29: Metals and energy currency futures contracts are

Q43: You have a record of an analyst's

Q68: Futures contracts are regulated by<br>A)the Commodities Futures

Q68: James Bright's company seeks markets all over

Q87: A trader who has a _ position