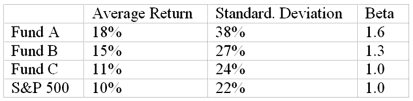

You want to evaluate three mutual funds using the Sharpe measure for performance evaluation.The risk-free return during the sample period is 4%.The average returns, standard deviations, and betas for the three funds are given below, as are the data for the S&P 500 Index.  The fund with the highest Sharpe measure is

The fund with the highest Sharpe measure is

Definitions:

Demonstrate Compliance

Showing evidence or actions that indicate adherence to laws, regulations, guidelines, or standards.

Monitor and Control Operations

The processes involved in observing system or business function performance and making adjustments as necessary to maintain desired levels.

Report's Recommendations

The proposed actions or advice concluded from an analysis contained within a report, aimed at addressing issues, improving situations, or informing decisions.

Executive Dashboards

Visual representation tools that display the current status of metrics and key performance indicators (KPIs) for an organization.

Q5: You are given the following information about

Q5: Pairs trading is associated with<br>A)triangular arbitrage.<br>B)statistical arbitrage.<br>C)data

Q9: Prior to expiration<br>A)the intrinsic value of a

Q9: After World War II, the United States

Q15: A portfolio manager's ranking within a comparison

Q24: A hedge fund attempting to profit from

Q25: The Treynor-Black model does not assume that<br>A)the

Q46: Fundamental analysis uses<br>A)earnings and dividends prospects.<br>B)relative strength.<br>C)price

Q70: A firm has a (net profit/pretax profit)

Q73: On January 1, you bought one April