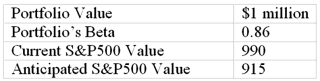

You are given the following information about a portfolio you are to manage.For the long-term you are bullish, but you think the market may fall over the next month.  How many contracts should you buy or sell to hedge your position Allow fractions of contracts in your answer.

How many contracts should you buy or sell to hedge your position Allow fractions of contracts in your answer.

Definitions:

Demand Instrument

A financial document that requires immediate payment upon presentation.

Specific Time

A precise or particular moment or duration identified for an event or action.

Negotiable Instrument

A written document guaranteeing the payment of a specified amount of money, either on demand or at a set time.

Relative Permanence

The quality of a negotiable instrument that ensures its longevity.

Q10: The _ equity market had the lowest

Q14: Suppose you own two stocks, A and

Q26: Which of the following political actions is

Q27: In the dividend discount model, which of

Q34: A measure of asset utilization is<br>A)sales divided

Q46: In a particular year, Aggie Mutual Fund

Q57: A _ is established when an individual

Q77: Compared to the foreign environment variables, which

Q83: In a particular year, Razorback Mutual Fund

Q85: Speculators may use futures markets rather than