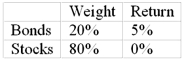

In a particular year, Razorback Mutual Fund earned a return of 1% by making the following investments in asset classes:  The return on a bogey portfolio was 2%, calculated from the following information.

The return on a bogey portfolio was 2%, calculated from the following information.  The total excess return on the Razorback Fund's managed portfolio was

The total excess return on the Razorback Fund's managed portfolio was

Definitions:

Sales

The total revenue generated from selling goods or services.

Variable Expenses

Costs that vary in direct proportion with the level of production or sales volume, such as raw materials and sales commissions.

Traceable Fixed Expenses

Fixed costs that are directly associated with a specific department or product, and can be directly traced to it.

Minimum Required Rate Of Return

The lowest acceptable return on an investment, determined by an investor's or company's risk tolerance.

Q15: Hedge funds often have _ provisions as

Q33: Consider the following: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB2464/.jpg" alt="Consider the

Q44: Discuss marking to market and margin accounts

Q46: Which of the variables affecting option pricing

Q46: Stephanie Watson is 23 years old and

Q46: In a particular year, Aggie Mutual Fund

Q47: Performance evaluation of hedge funds is complicated

Q58: You wish to earn a return of

Q64: The current market price of a share

Q89: A specific unit or dollar limit applied