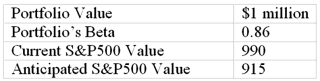

You are given the following information about a portfolio you are to manage.For the long-term you are bullish, but you think the market may fall over the next month.  How many contracts should you buy or sell to hedge your position Allow fractions of contracts in your answer.

How many contracts should you buy or sell to hedge your position Allow fractions of contracts in your answer.

Definitions:

Cost Function

A mathematical relation that describes how the total cost of producing a good or service varies with the level of output.

Diseconomies of Scope

The phenomenon where a company’s costs increase as it produces more varied types of products or services, due to inefficiencies.

Returns to Scale

The rate at which output increases as inputs are increased proportionately.

Economies of Scope

Cost advantages companies experience when they increase the variety of products produced, as opposed to increasing the volume of a single product (economies of scale).

Q15: Assume there is a fixed exchange rate

Q19: You are given the following information about

Q29: A portfolio consists of 100 shares of

Q36: The growth in dividends of ABC, Inc.is

Q39: You are managing a portfolio that consists

Q58: The M-squared measure considers<br>A)only the return when

Q73: Siri had a FCFE of $1.6M last

Q75: The elasticity of an option is<br>A)the volatility

Q80: Foreign currency futures contracts are actively traded

Q89: Mature Products Corporation produces goods that are