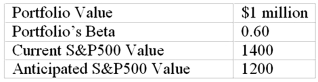

You are given the following information about a portfolio you are to manage.For the long-term you are bullish, but you think the market may fall over the next month.  If the anticipated market value materializes, what will be your expected loss on the portfolio

If the anticipated market value materializes, what will be your expected loss on the portfolio

Definitions:

Lazy

A lack of willingness to work or use energy; showing a dislike for physical or mental effort.

Extra Shift

An additional work period taken on by an employee, beyond their regular working hours.

Actor-Observer Effect

A cognitive bias involving the tendency to attribute one's own actions to external causes while attributing others' behaviors to their character.

Situational Causes

Factors relating to the environment or specific circumstances outside an individual that contribute to their behavior.

Q5: All else equal, call option values are

Q25: The Treynor-Black model does not assume that<br>A)the

Q26: Which one of the following variables influence

Q27: The emerging market country with the lowest

Q28: If a portfolio manager consistently obtains a

Q31: Taxation of futures trading gains and losses<br>A)is

Q57: What is an option hedge ratio<br> How

Q69: Each of two stocks, C and D,

Q78: _ and the World Bank Group are

Q84: Which of the following is an example