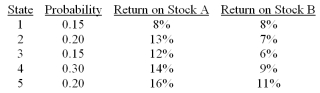

Consider the following probability distribution for stocks A and B:  The standard deviations of stocks A and B are _____ and _____, respectively.

The standard deviations of stocks A and B are _____ and _____, respectively.

Definitions:

Non-participant Observation

A research method where the observer does not engage with the participants, allowing for the study of behaviors and events in their natural setting without influence.

Independent Variable

A variable in research that is manipulated or changed to observe its effect on a dependent variable.

Experimental Group

The group in an experiment that receives the variable being tested, allowing researchers to measure the effect of the variable on this group.

Theoretical Framework

A structure of concepts, theories, and propositions that provides a systematic view of phenomena by specifying relations among variables, with the aim of explaining and predicting phenomena.

Q5: You purchased shares of a mutual fund

Q11: Analysts may use regression analysis to estimate

Q21: Suppose you held a well-diversified portfolio with

Q24: A purchase of a new issue of

Q30: The optimal proportion of the risky asset

Q40: Analysts may use regression analysis to estimate

Q42: There are three stocks, A, B, and

Q49: The Securities Act of 1934 I) requires

Q55: The risk-free rate is 4%.The expected market

Q81: As a financial analyst, you are tasked