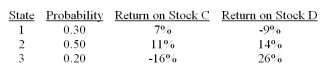

Consider the following probability distribution for stocks C and D:  If you invest 25% of your money in C and 75% in D, what would be your portfolio's expected rate of return and standard deviation

If you invest 25% of your money in C and 75% in D, what would be your portfolio's expected rate of return and standard deviation

Definitions:

Assets

Resources owned or controlled by a business or an individual, which are expected to produce economic value or benefit in the future.

Additional Shares

Shares issued by a company in addition to its existing shares, often to raise extra capital.

Financial Reporting

Generating documents that communicate a company's economic situation to its leadership, shareholders, and regulatory agencies.

External Decision Makers

Individuals or organizations outside of a company (e.g., investors, creditors, regulators) who use the company’s financial information to make decisions about engaging with the company.

Q1: Which of the following statements regarding the

Q23: Which of the following orders instructs the

Q24: Which of the following statements about real

Q28: Restrictions on trading involving insider information apply

Q46: Statman (1977) argues that _ is consistent

Q50: Which of the following statement(s) is(are) true

Q55: The risk-free rate is 4%.The expected market

Q62: Discuss some reasons why an investor with

Q69: If the interest rate paid by borrowers

Q80: Economists assume that rational behaviour is useful