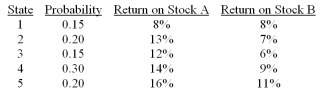

Consider the following probability distribution for stocks A and B:  If you invest 35% of your money in A and 65% in B, what would be your portfolio's expected rate of return and standard deviation

If you invest 35% of your money in A and 65% in B, what would be your portfolio's expected rate of return and standard deviation

Definitions:

Irrigated Land

Agricultural land that is supplied with water through artificial means to promote crop growth.

Salinity

The concentration of dissolved salts in a given volume of water.

Water Restrictions

Measures implemented to limit the use of water resources typically in response to drought or water scarcity.

Underground Aquifers

Natural underground reservoirs that store water, sourced from rain or melting snow that seeps through soil and rocks.

Q9: Consider the following probability distribution for stocks

Q22: Discuss how the investor can use the

Q34: The premise of behavioral finance is that<br>A)conventional

Q41: You purchased a futures contract on corn

Q45: Consider the single-factor APT.Stocks A and B

Q51: Early tests of the CAPM involved<br>A)establishing sample

Q55: Which of the following statement(s) is(are) true

Q66: Draw a graph of a typical efficient

Q71: Suppose the following equation best describes the

Q78: You invest 50% of your money in