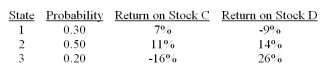

Consider the following probability distribution for stocks C and D:  If you invest 25% of your money in C and 75% in D, what would be your portfolio's expected rate of return and standard deviation

If you invest 25% of your money in C and 75% in D, what would be your portfolio's expected rate of return and standard deviation

Definitions:

African American

A term describing Americans of African descent, emphasizing the cultural, historical, and social aspects of the African American experience.

Religious Values

Core beliefs and moral principles derived from religious teachings that guide an individual's behavior and decision-making.

Family Service Policies

Guidelines and rules designed to govern the delivery of services and support to families within an organizational or governmental context.

Come Out

The act of disclosing one's LGBTQ+ identity to others.

Q11: Information processing errors consist of I) forecasting

Q12: Initial margin requirements are determined by<br>A)the Securities

Q17: If you believe in the reversal effect,

Q21: Unsecured bonds are called<br>A)junk bonds.<br>B)debentures.<br>C)indentures.<br>D)subordinated debentures.<br>E)either debentures

Q22: Barber and Odean (2000) ranked portfolios by

Q26: Name three variables that Chen, Roll, and

Q36: Two popular moving average periods are<br>A)90-day and

Q41: As diversification increases, the total variance of

Q47: In 2012, _ was the most significant

Q99: Suppose that some investors have decided that