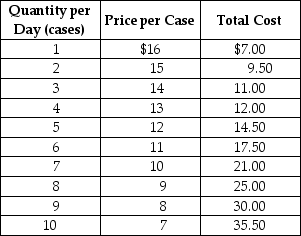

Table 9.2  The government of a small developing country has granted exclusive rights to Linden Enterprises for the production of plastic syringes.Table 9.2 shows the cost and demand data for this government protected monopolist.

The government of a small developing country has granted exclusive rights to Linden Enterprises for the production of plastic syringes.Table 9.2 shows the cost and demand data for this government protected monopolist.

-Refer to Table 9.2.The amount of profit that the firm earns is

Definitions:

Gross Profit

The difference between revenue and the cost of goods sold before deducting overheads, payroll, taxation, and interest payments.

LIFO

Last In, First Out, an inventory valuation method where the goods purchased or produced last are the first to be expensed.

Tax Rate

The percentage at which an individual or corporation is taxed.

FIFO Method

Stands for "First-In, First-Out," a technique to value inventory and determine the cost of goods sold by assuming that the oldest items are sold first.

Q63: If price exceeds average variable cost but

Q66: The difference between allocative efficiency and productive

Q75: If a perfectly competitive firm raises the

Q88: Assuming a market price of $4, fill

Q174: Which of the following products allows the

Q223: What is allocative efficiency?<br>A)It refers to a

Q234: Refer to Table 10.5.The firm's profit-maximising or

Q235: Refer to Figure 7.14.Suppose Hilda produces 100

Q240: Refer to Figure 8.5.The figure shows the

Q252: Refer to Figure 7.6.In the figure above,