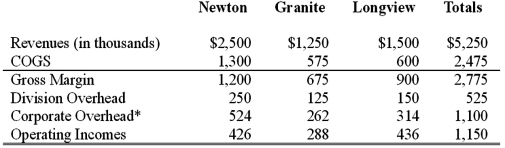

Performance of divisional managers at Leakproof Faucet Corporation is judged by an evaluation of the operating incomes of the divisions. Abbreviated income statements for the year ending 2013 are shown below for the three divisions of Leakproof Faucet Corp:

*Total Corporate Overhead is allocated to each division based on the division's proportion of total revenues.

*Total Corporate Overhead is allocated to each division based on the division's proportion of total revenues.

The manager of the Newton division, through increases in manufacturing efficiency, created some additional capacity in 2013. The only way he could have utilized this capacity would have been to manufacture a model J-5 faucet, which would have had the following impact on the Newton division:

Increase in annual revenues (in thousands) of $750.

Increase in cost of goods sold of $600.

Increase in divisional overhead of $100.

Mr. Garrett, the Newton division manager, chose not to manufacture the J-5 faucets; therefore, the additional capacity went unused.

Required:

(1) Prepare revised income statements for the three divisions for 2013 assuming that Mr. Garrett had chosen instead to utilize the additional capacity to manufacture the model J-5.

(2) Calculate the contribution margin of the Newton division if J-5 is manufactured and if it is not manufactured.

(3) Why did Mr. Garrett choose not to manufacture the J-5?

(4) Would Leakproof Faucets have benefited from the manufacture of the J-5?

(5) Identify an advantage and a disadvantage of not allocating any corporate overhead to the divisions.

Definitions:

All Ecosystems

The entirety of ecosystems, encompassing diverse environments from tropical forests to desert habitats, each with their unique interactions among living organisms and their surroundings.

Ethical Concern

A situation that requires individuals or organizations to choose between actions that must be evaluated as right or wrong, often involving a moral dilemma.

Animal Species

Distinct groups of animals that share common characteristics and can interbreed to produce fertile offspring, each adapted to specific environments and ways of life.

Environmental Revolution

A significant change in society's approach to environmental conservation and sustainability, often driven by policy, innovation, and cultural shifts.

Q13: According to Henri Fayol, discipline refers to:<br>A)

Q13: The two major contributing factors to a

Q24: Which one of the following develops the

Q41: All of the following are examples of

Q52: A method for determining a bonus based

Q73: (Units sold - budgeted sales units) x

Q79: A company had income of $50,000 using

Q100: Managerial performance can be measured in various

Q102: Which of the following is true of

Q104: Variable costing operating income for 2013 is