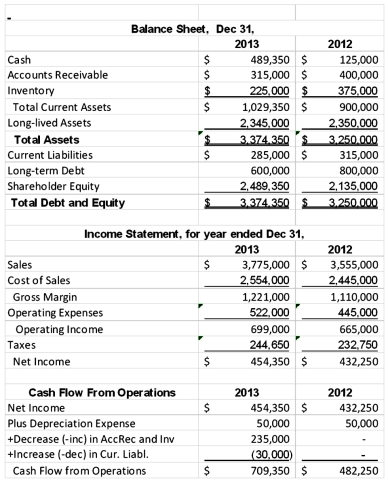

Jackson Manufacturing has the following operating results for 2013.

In addition, the company paid dividends in both 2012 and 2013 of $100,000 per year and made capital expenditures in both years of $45,000 per year. The company's stock price in 2012 was $10 and $12 in 2013. The industry average earnings multiple for the industry was 10 in 2013 and the free cash flow and sales multiples were 20 and 2, respectively. The company is publicly owned and has 1,050,000 shares of outstanding stock at the end of 2013. The industry average ratios for Jackson's industry were as follows in the most recent year.

In addition, the company paid dividends in both 2012 and 2013 of $100,000 per year and made capital expenditures in both years of $45,000 per year. The company's stock price in 2012 was $10 and $12 in 2013. The industry average earnings multiple for the industry was 10 in 2013 and the free cash flow and sales multiples were 20 and 2, respectively. The company is publicly owned and has 1,050,000 shares of outstanding stock at the end of 2013. The industry average ratios for Jackson's industry were as follows in the most recent year.

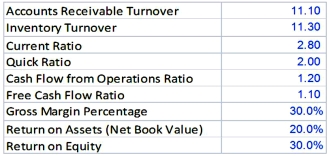

Exhibit A: Industry Ratios for the Jackson Company  Required:

Required:

1. Calculate the ratios In Exhibit A for Jackson Company for 2013, group them by category (liquidity, profitability) and develop a brief overview for the liquidity and profitability of the Jackson Company at the end of 2013.

2. Complete a Business Valuation for the Jackson Company based on 2013 financial statement information.

Definitions:

Households

Units of one or more persons living together who make joint decisions on consumption, work, and income generation.

Discrimination Coefficient

A measure in economics and social sciences to quantify the degree of discrimination or bias shown towards or against a particular group or individual.

Wage Differential

The difference between the wage received by one worker or group of workers and that received by another worker or group of workers.

Taxes

Mandatory financial charges or levies imposed by a government on individuals or organizations to fund public expenditures.

Q10: If the minimum rate of return is

Q14: Turnover can hurt an organization because it

Q23: When tobacco companies sought to hide evidence

Q27: Identify the appropriate cost-of-quality (COQ) category for

Q33: In a(n) _ culture, managers are likely

Q45: The attraction-selection-attrition framework suggests that the founders

Q48: Which of the following is not a

Q98: Fayol's principle of initiative suggests that:<br>A) employees

Q111: Other things being equal, income computed by

Q133: The set of international quality-related standards, adopted