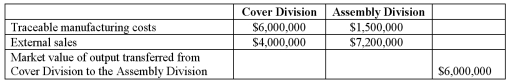

Simmons Bedding Company manufactures an array of bedding-related products, including pillows. The Cover Division of Simmons makes covers, while the Assembly Division of the company produces finished pillows. The covers can be sold separately for $10.00 a piece, while the pillows sell for $12.00 per unit. For performance-evaluation purposes, these two divisions are treated as investment centers. Financial results from the most recent accounting period are as follows:

Required:

Required:

1. What is the operating income for each of the two divisions and for the company as a whole? (Use market value as the transfer price.)

2. Do you think each of the two divisional managers is happy with this transfer-pricing method? Explain.

Definitions:

Q4: Emma is a highly efficient manager. This

Q5: Oslo Company's target quality characteristic, T, for

Q15: For Cost of Quality (COQ) reporting purposes,

Q26: The primary message of _ is that

Q36: The value of the company, calculated using

Q66: An electronic component has an output voltage

Q73: During the planning process, managers lay out

Q88: Chering Division's return on sales (ROS) is:<br>A)6.0%.<br>B)8.0%.<br>C)14.0%.<br>D)15.0%.<br>E)20.0%.

Q145: Lean manufacturing principles are derived in large

Q146: What is the change in total quality