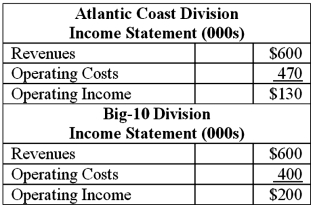

T-shirts R Us Inc. operates two divisions that each manufactures t-shirts for universities. Each division has its own manufacturing facility. The historical-cost accounting system reports the following data for 2013.

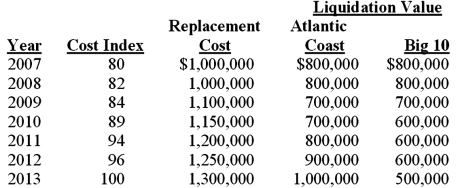

T-shirts R Us Inc. estimates the useful life of each manufacturing facility to be 15 years. The company uses straight line depreciation, with a depreciation charge of $70,000 per year for each division and no salvage value at the end of 15 years. The manufacturing facility is the only long-lived asset of either division. Current assets are $300,000 in each division. At the end of 2013 the Atlantic Coast Division is 4 years old and the Big 10 Division is 6 years old. An index of construction costs, replacement cost, and liquidation values for manufacturing facilities for production of t-shirts for the 7-year period that T-shirts R Us Inc. has been operating is as follows:

T-shirts R Us Inc. estimates the useful life of each manufacturing facility to be 15 years. The company uses straight line depreciation, with a depreciation charge of $70,000 per year for each division and no salvage value at the end of 15 years. The manufacturing facility is the only long-lived asset of either division. Current assets are $300,000 in each division. At the end of 2013 the Atlantic Coast Division is 4 years old and the Big 10 Division is 6 years old. An index of construction costs, replacement cost, and liquidation values for manufacturing facilities for production of t-shirts for the 7-year period that T-shirts R Us Inc. has been operating is as follows:  Required:

Required:

Round answers to 2 decimal places where appropriate.

1. Compute return on investment (ROI) for each division using net book value (NBV). Interpret the results.

2. Compute return on investment (ROI) for each division, incorporating current-cost estimates as follows, using:

(a) Gross book values (GBV) under historical cost;

(b) GBV at historical cost restated to current cost using the index of construction costs;

(c) NBV of long-lived assets restated at current cost using the index of construction costs (the facility was constructed the year before the first year of use);

(d) Current replacement cost; and

(e) Current liquidation value.

3. Which of the measures calculated in (2) above would you choose for (a) performance evaluation of each division manager, and (b) deciding which division is most profitable for the overall firm. What are the strategic advantages and disadvantages to the firm of each measure for both (a) and (b)?

Definitions:

Formal Authority

The power or right to give orders, make decisions, and enforce obedience, typically within an organizational hierarchy.

Influence

The capacity to have an effect on the character, development, or behavior of someone or something.

Coercive Power

The ability of a person to compel or force someone else to act in a certain way through threats, punishment, or control measures.

Withhold Positive Outcomes

The act of not presenting or delaying favorable results or benefits.

Q16: The return on sales (ROS) for Division

Q25: First-line managers typically supervise middle managers.

Q43: Paquindo Co. has two products: X and

Q62: Which of the following is true of

Q66: A company that wishes to increase the

Q72: Performance of divisional managers at Leakproof Faucet

Q73: Management science theory focuses on the use

Q85: The importance of planning, organizing, leading, and

Q105: The Daniels Tool & Die Corporation has

Q111: The following questions pertain to the process