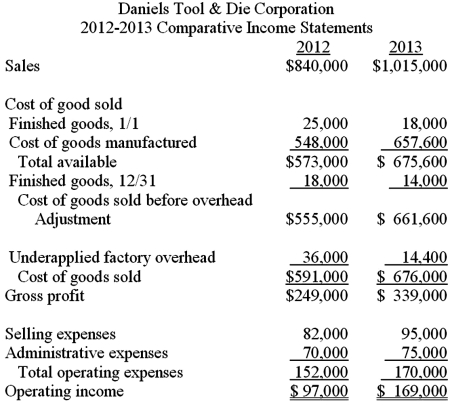

The Daniels Tool & Die Corporation has been in existence for a little over three years; its sales have been increasing each year as it has built a reputation. The company manufactures dies to its customers' specifications; as a consequence, a job order cost system is employed. Factory overhead is applied to the jobs based on direct labor hours. Actual variable overhead is the same as applied variable overhead. Overapplied or underapplied overhead is treated as an adjustment to cost of goods sold. The company's income statements for the last two years are presented below.

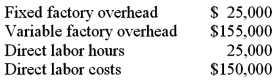

Daniels used the same predetermined overhead rate in applying overhead to production orders in both 2012 and 2013. The rate was based on the following estimates:

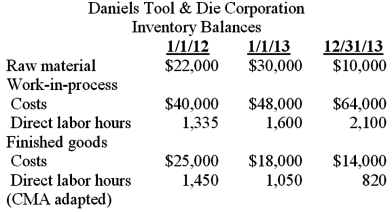

In 2012 and 2013, actual direct labor hours expended were 20,000 and 23,000, respectively. Raw materials put into production were $292,000 in 2012 and $370,000 in 2013. Actual fixed overhead was $37,400 for 2013 and $42,300 for 2012, and the planned direct labor rate was the direct labor rate achieved.

In 2012 and 2013, actual direct labor hours expended were 20,000 and 23,000, respectively. Raw materials put into production were $292,000 in 2012 and $370,000 in 2013. Actual fixed overhead was $37,400 for 2013 and $42,300 for 2012, and the planned direct labor rate was the direct labor rate achieved.

For both years, all of the reported administrative costs were fixed, while the variable portion of the reported selling expenses result from a commission of five percent of sales revenue.

Required:

(1) For the year December 31, 2013, prepare a revised income statement for Daniels Tool & Die Corporation utilizing the variable costing method. Be sure to include the contribution margin on your statement.

(2) Prepare a numerical reconciliation of the difference in operating income between Daniels Tool & Die Corporation's costing and the revised 2013 income statement prepared on the basis of variable costing.

(3) Describe both the advantages and disadvantages of using variable costing.

Definitions:

Pyloric Sphincter

A muscular valve regulating the flow of food from the stomach to the duodenum of the small intestine.

Anal Sphincter

A circular muscle that surrounds the anus, controlling the passage of feces out of the body through the anal opening.

Salivary Glands

Glands located in the mouth that produce saliva, aiding in digestion and keeping the mouth moist.

Gallbladder

An organ that stores bile produced by the liver, releasing it into the small intestine to aid in digestion.

Q3: The difference between the historical cost and

Q46: The cost method that is input-oriented and

Q75: In a standard cost system, when production

Q80: What is the total factory overhead flexible-budget

Q104: The contribution margin sales volume variance for

Q105: The total amount of the bonus pool

Q108: The measure of how productively an organization

Q127: For production and support departments, a method

Q132: Provide a definition of the term "quality,"

Q136: List three examples of quality improvement in