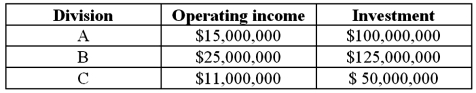

Meridian Investments has three divisions (A, B, C) organized for performance-evaluation purposes as investment centers. Each division's required rate of return for purposes of calculating residual income (RI) is 15%. Budgeted operating results for 2013 for each of the three divisions are as follows:

The company is planning an expansion, which will require each division to increase its investments by $25,000,000 and its income by $4,500,000.

The company is planning an expansion, which will require each division to increase its investments by $25,000,000 and its income by $4,500,000.

Required:

1. Compute the current ROI for each division.

2. Compute the current residual income (RI) for each division.

3. Rank the divisions according to their current ROIs and residual incomes.

4. Determine the effects after adding the new project to each division's ROI and residual income (RI).

5. Assuming the managers are evaluated on either ROI or residual income (RI), which divisions are pleased with the expansion and which ones are unhappy? Explain briefly.

Definitions:

Forest Fires

Uncontrolled fires that occur in wooded areas, potentially causing widespread damage to ecosystems, properties, and human life.

Distribution

The way in which something is shared out or spread across a range, often referring to the probability distribution of a variable.

Histogram

A graphical representation of the distribution of numerical data, typically showing the frequency of data within specified intervals.

Statistica Neerlandica

A peer-reviewed scientific journal covering research in all areas of statistics.

Q5: The current ratio for 2013 is:<br>A)1.8<br>B)2.0<br>C)3.9<br>D)4.7

Q10: If the minimum rate of return is

Q24: Discuss Fayol's principles of management.

Q65: Which of the following statements is not

Q82: The sales volume variance is:<br>A)Further divided into

Q87: Return on investment (ROI) can be directly

Q110: What are the three major needs identified

Q118: "Outsourcing" a cost center is often done

Q120: The "cost of conformance" in a Cost-of-Quality

Q134: The weighted-average budgeted contribution margin per unit