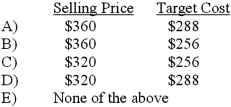

Baldwin produces bicycles in a highly competitive market. During the past year, the company has added a 20% markup on the $300 manufacturing cost for one of its most popular models. A new competitor recently entered the market with a competitive model that is priced at $320, seriously eroding Baldwin's market share. Management now desires to use a target-costing approach to remain competitive and is willing to accept a 20% return on sales. If target costing is used, which of the following choices correctly denotes (1) Baldwin's selling price and (2) Baldwin's target cost?

Definitions:

Equal Monthly Payments

Equal monthly payments refer to the uniform payment amount made in each period, often seen with loans like mortgages, where principal and interest are paid off over time.

Nominal Annual Rate

The interest rate stated on a loan or financial product, not adjusting for inflation or the compounding of interest within that year.

Expected Annual

Refers to the anticipated yearly financial performance or returns, often used in the context of earnings, returns, or income.

Inflation

The rate at which the general level of prices for goods and services is rising, eroding purchasing power.

Q14: The difference between total variable overhead cost

Q19: The effect of the sales volume variance

Q31: Financial budgets include the:<br>A)Pro forma balance sheet.<br>B)Projected

Q88: The direct labor flexible-budget variance of the

Q96: List factors that should be considered in

Q98: Omaha Plating Corporation is considering purchasing a

Q123: The fixed overhead spending variance for Megan,

Q135: The production-volume variance should generally not be

Q142: Capital One's management believes that a 10%

Q143: Assume only the specified parameters change in