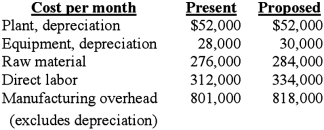

Apex Manufacturing Corporation is considering a significant shift in the mix of products it manufactures. The costs associated with current and proposed production schedules are shown below by category:  The proposed production will require a one-time purchase of equipment costing $180,000. No change in selling or administrative cost from their present levels is expected.

The proposed production will require a one-time purchase of equipment costing $180,000. No change in selling or administrative cost from their present levels is expected.

Required:

1. What type of relevant cost analysis would be appropriate in this situation (special order, make-lease-buy, etc.)? Why?

2. What role does depreciation and equipment purchase cost play in this decision?

3. What is the minimum amount that revenue would have to increase per month to justify the proposed production schedule? Ignore taxes and the time value of money

Definitions:

Pareto Efficient

An economic state where resources are allocated in a way that it is impossible to make any one individual better off without making at least one individual worse off.

Efficiency

A measure of how well resources are used to achieve a goal, maximizing output from given inputs without waste.

Equity

The concept of fairness or justice, often discussed in the distribution of wealth, or the ownership interest in a firm.

Perfectly Competitive System

A market structure where many firms offer products or services that are similar, leading to a high level of competition and prices that reflect the true supply and demand.

Q11: Which of the following methods considers all

Q16: The p-value is a measure of:<br>A)The precision

Q16: Explain the calculation and interpretation of a

Q19: The sales volume variance in terms of

Q27: Slumber Company is considering two mutually exclusive

Q30: Papa Joe, Inc., is preparing its budget

Q37: To achieve the target cost, Lens Care

Q74: Zero-base budgeting (ZBB) differs from traditional budgeting

Q89: Which of the following is not an

Q148: What was the average direct labor hourly