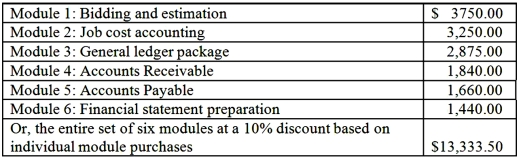

Acorn Corporation designs and installs fire-suppression systems in commercial buildings. Over 90 percent of Acorn's business is in new construction, with the remainder in upgrade installations in remodeled buildings. For planning and control purposes, Acorn's controller (Jane Reid) is considering purchasing cost and financial accounting software from Constructor Solutions, Inc. Costs for the software modules are shown below:  Required:

Required:

1. Jane uses value-chain analysis in evaluation of capital investments. She asks you which method, internal rate of return (IRR) or net present value (NPV), would be best in selecting individual software modules, and your reason(s) for the choice of method.

2. Jane says, "If we buy the entire set of six modules, we will get the equivalent of Module 6 free." Why might this savings of almost $1,500 be illusory?

3. The present value of the cost savings generated by the set of six modules, based on a five-year life and discount rate of 18 percent, is estimated as $13,844.50. Should the set of six modules be purchased? Explain. How would your decision be affected if Acorn's minimum rate of return were 24 percent? (No calculations are necessary to answer this question.)

Definitions:

Erythropoietin

A hormone produced mainly by the kidneys, stimulating the production and maintenance of red blood cells in response to low oxygen levels in tissues.

Platelet Plug

A mass formed by platelets that accumulates at a site of blood vessel injury to help stop bleeding.

Vasoconstriction

The constriction of blood vessels that elevates blood pressure and diminishes blood circulation to specific regions.

Thromboxane

Specific class of physiologically active fatty acid derivatives present in many tissues.

Q1: Technology and complexity issues often lead management

Q8: When there is limited capacity, the minimum

Q26: Which of the following is a common

Q62: The Crown Company must decide whether to

Q78: The sequence of activities within the firm

Q116: The following information is available from

Q118: Quinta Inc. manufactures machine parts for aircraft

Q123: Ignoring income tax considerations, how is depreciation

Q153: Marc Corporation wants to purchase a

Q164: Quip Corporation wants to purchase a new