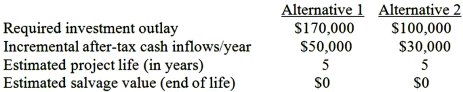

Slumber Company is considering two mutually exclusive investment alternatives.Its estimated weighted-average cost of capital, used as the discount rate for capital budgeting purposes, is 10%.Following is information regarding each of the two projects:  Required:

Required:

1.Compute the estimated net present value of each project and determine which alternative, based on NPV, is more desirable.(The PV annuity factor for 10%, 5 years, is 3.7908.)

2.Compute the profitability index (PI) for each alternative and state which alternative, based on PI, is more desirable.

3.Why do the project rankings differ under the two methods of analysis? Which alternative would you recommend, and why?

Definitions:

Calling Object

The object on which a method is invoked. In object-oriented programming, methods are called on objects to perform actions or access values.

Clone Method

A method that creates and returns a copy of an object, often used to duplicate instances with the same properties.

CloneNotSupportedException

An exception in Java indicating an attempt to clone an object that does not implement the Cloneable interface.

Inner Classes

Inner Classes in Java are defined within the body of another class and can access all the members (including private ones) of the outer class.

Q24: At the breakeven point, total fixed cost

Q31: In terms of the variance-investigation decision under

Q35: In September, Larson Inc. sold 40,000 units

Q40: Which of the following is a theory

Q45: Fashions, Inc.is a retail store that sells

Q51: In least squares regression analysis, the cost

Q71: Critics (for example, The Beyond Budgeting Roundtable)

Q71: Multiple regression analysis:<br>A) Establishes a cause and

Q82: Felinas Inc. produces floor mats for cars

Q124: Minmax Co.'s direct labor information for