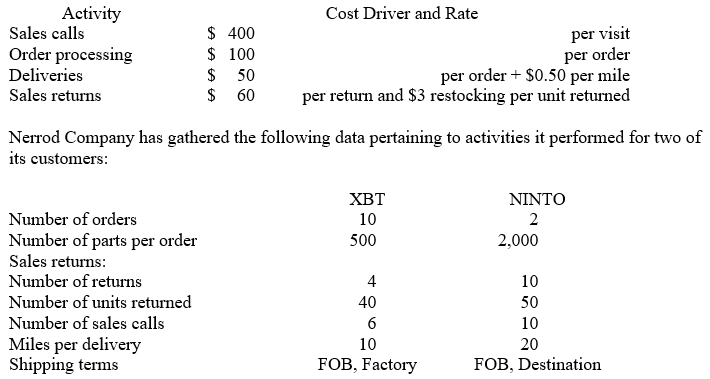

Nerrod Company sells its products at $500 per unit, net 30. The firm's gross margin ratio is 40 percent. The firm has estimated the following operating costs: What is Nerrod's total sales-sustaining cost applicable to XBT as a customer?

What is Nerrod's total sales-sustaining cost applicable to XBT as a customer?

Definitions:

CCA Class

Capital Cost Allowance Class; categories used in Canadian tax law to determine the depreciation rate for tax purposes on tangible and intangible assets.

Depreciation Expense

An accounting method that allocates the cost of a tangible asset over its useful life to account for the decline in its value over time.

Fixed Assets

Durable physical assets owned and utilized by a company in its operations for the purpose of producing revenue.

Erosion

The gradual reduction or depletion of an asset's value, often due to competitive market forces or the introduction of new products.

Q9: The point in a joint production process

Q18: The Subway Sandwich Shop, Inc.is seeking to

Q24: JCH Company conducts business in the lumber

Q46: Burmer Co. has accumulated data to use

Q50: Cleaning Care Inc. expects to sell 10,000

Q59: If estimated annual factory overhead is $480,000;

Q66: Sutherland Company listed the following data

Q74: Which of the following items is not

Q96: Material P is added at the beginning

Q138: Wang Company has established the following overhead